Investing In Kratom: The Basics

Individuals looking to make kratom investments typically want a slice of the sweet projected growth within the industry. If consumers believe in something they purchase, it’s an initiative to invest if they have the resources and desire to do so.

Kratom is usually integral to someone’s life once they regularly use it. Many turn to kratom to control pain and promote energy, positivity, better sleep, and calmness. They will stand by it when they find something that can impact their lives and make them more comfortable and content. This is where investors are born, and typically, investors turn to the stock market as a knee-jerk impulse.

The stock market allows potential investors to seize the opportunity to tap into a business already up and running. Doing so helps individuals utilize their prospects for a wealthy investment return.

Challenges can present themself depending on what industry you’re investing in, proving it difficult to find any viable stock. Unfortunately, kratom appears to fall into this category.

There has been debate about whether kratom companies can go public in America due to its classification as a scheduled substance in certain states. However, this isn’t likely the case because kratom is federally legal.

Kratom Investment Complications

Since kratom is legal at the federal level, and a company exists where it’s legal, it should have the option of filing an Initial Public Offering, or IPO, with the Securities Exchange Commission (SEC).

It’s not that simple. The process for transitioning a company would place heavy burdens on a kratom investment. A company would be required to apply and be approved by the SEC first and foremost.

SEC approval entails a lengthy, meticulous process. First, the company must provide due diligence to the government agency. Then, the Security Exchange Commission examines all financial records on file with a fine-tooth comb. This can result in more headaches than the company bargained for.

A current issue is that United States banking institutions place undue restrictions on kratom businesses, leaving these companies with no choice but to use high-risk merchant services to provide their customers with payment portals. Sometimes, kratom vendors may find a loophole or fudge the truth to give their customers access to standard payment processors they are familiar with. However, going public or applying for an IPO would permanently strip them of these options.

It doesn’t help that the FDA continues to push back the kratom industry. Federal and state laws are constantly changing in America, especially since lawmakers and elected officials tend to push their agendas. Moreover, kratom stocks would likely be too volatile to be trustworthy, as the threat or even talk about a federal ban would destroy whatever chance it had of growing.

Even state bans would jeopardize a company. Moving to a different location isn’t always the easiest option. As it incurs extra fees for relocating, it may reflect poorly and ultimately hurt the shareholders.

Over-The-Counter Stocks: Are These the Answer?

Stock offerings for companies in the psychedelic and cannabis sectors have recently become available to investors. So how could illegal substances with so much controversy surrounding them make their way onto the stock exchange? Let us explain.

The cannabis stocks are Canadian-founded companies. Each belongs to legitimate businesses within a country where weed is legal. As for the psychedelic companies, they are trying to reach FDA-approved drugs using specific plant alkaloids. One of these businesses began its journey to the stock exchange via the same platform that American cannabis companies use: the Over-The-Counter (OTC) Market.

Companies wanting to go public on a stock exchange must hop through many obstacles and hurdles if they’re listed. However, the OTC market offers a higher level of anonymity for companies. It requires the form provided by the Financial Industry Regulatory Authority, or FINRA, to be completed and submitted. Businesses are not legally obligated to be entirely transparent with their financial statements. It has become the preferred path for going public in the herbal pharma industry.

Today, we know of one company affiliated with kratom: Sibannac Inc. Instead of selling kratom, it has formulated a beverage line containing kratom’s precious alkaloids. However, this product is still in development.

Kratom-Affiliated Stock & Nasdaq

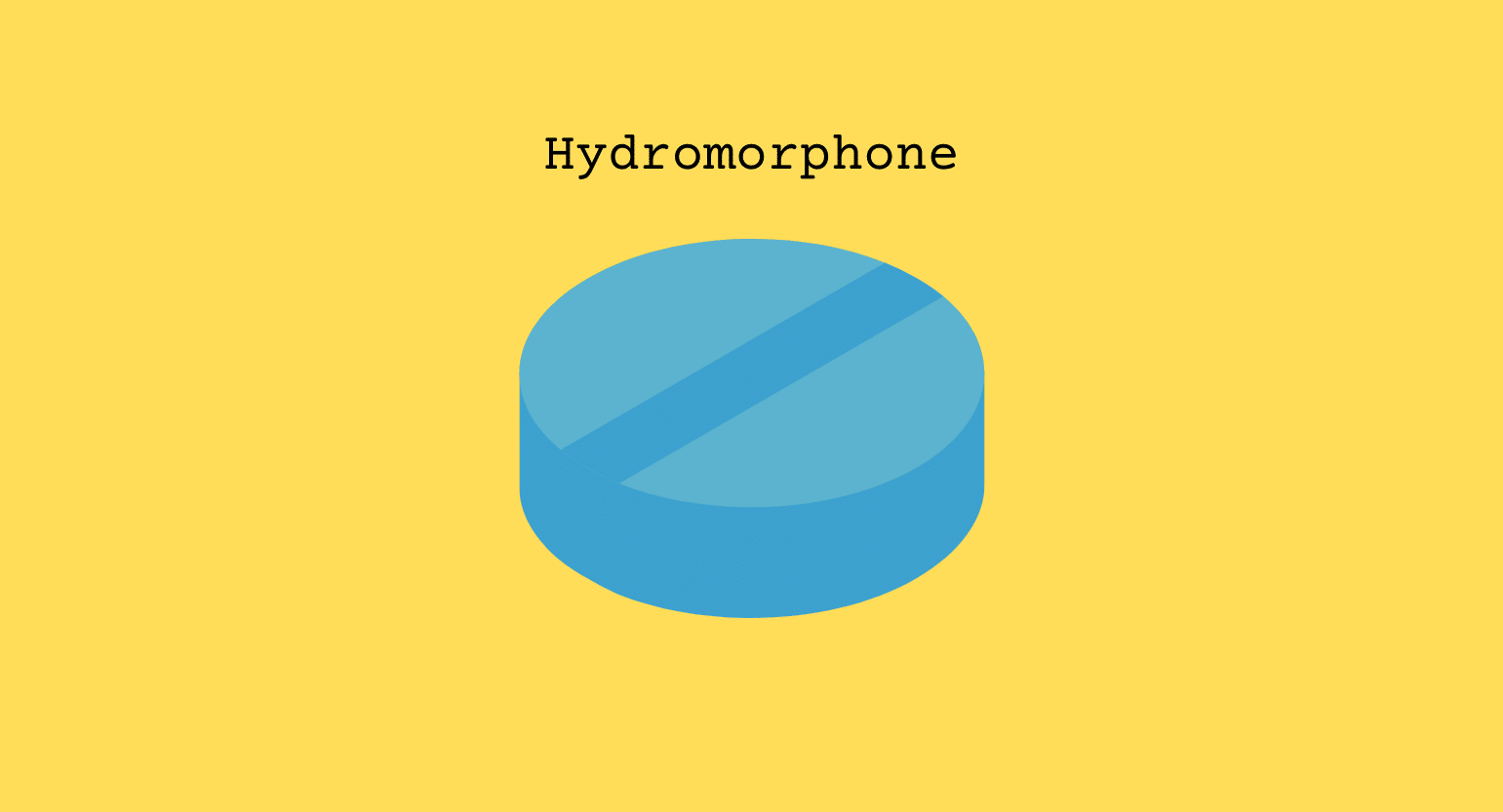

While there may not be any current kratom businesses listed on the stock exchanges, one has surfaced recently on the Nasdaq related to Mitragyna speciosa. A biotechnology company called ATAI Life Sciences acquired most stakes in Kures, a pharmaceutical research company utilizing kratom to create medicines derived from the alkaloids, primarily mitragynine, found in its leaves.

ATAI Life Sciences’ IPO went public on June 18th, 2021. The business set the terms for its IPO and requested over $200 million from its public offering [3]. The company filed with the SEC to offer 16.43M shares for the public to purchase. The estimated price range of each share reached between $13-$15 per share during the initial bidding process. When the company debuted on the exchange, the stock opened at $21 per share, dropping off slightly afterward.

Right now, it floats at about $18 per share. However, it’s estimated to gain some traction as new information is released about the progression of drug trials. If one of the ATAI-backed companies receives FDA approval, the stock will surely skyrocket.

Since ATAI Life Sciences is the only kratom-affiliated business on the stock exchange, many have noticed. FDA-approved drugs derived from mitragynine would be precious to shareholders.

Donate To Non-Profit Organizations Fighting for Kratom

Our elected officials and lawmakers ultimately hold the key to kratom’s future. The market is consistently left wondering what direction it should be heading or what steps it should be taking to navigate turbulent political waters.

Plant-based remedies and medicines are in a windy climate, and things tend to shift dramatically over the slightest breeze. Unfortunately, this volatility would discourage most individuals in this industry from spending time, energy, and money to push forward when their ideas may never be able to succeed.

Remember that big plays lead to significant rewards if they work out. We may see some pushing the boundaries of the industry to its limits, which may end up placing a kratom company’s ticker on the Nasdaq. Without motivation and determination, the kratom industry would disintegrate. Fortunately, kratom has significantly impacted many’s lives, meaning that the passion is there.

Individuals can help a cause they are passionate about by donating to non-profit organizations specializing in speaking out and supporting the kratom industry. For example, the American Kratom Association, also known as the AKA, has been continuously battling to prevent the spread of misinformation, lies, and fear-mongering surrounding this tropical plant. As a result, this advocacy group regularly faces Congress to be the voice of this herbal remedy, and the group could be the key to purchasing stocks related to kratom in the future.

Supporting these activist groups that address those who oppose kratom, ask questions no one wants to answer, and share the information and statistics that need to be shared is a critical element of the industry’s future. Without consumers backing these products, they have no case. So if you’re a regular kratom user and you’ve noticed the positive impact it has had on your life, don’t hesitate to get out, participate, and use that knowledge to help pave the way to success.

Conclusion: Investing in Kratom

Investing in kratom is an area that is currently somewhat chaotic. There aren’t many options, and stocks related to the alkaloids found in kratom are only slowly popping up. Unfortunately, there is no fast-forward button. We will have to remain patient and vigilant, taking and seizing any opportunities to support the industry in its journey.